Our Views

Finance

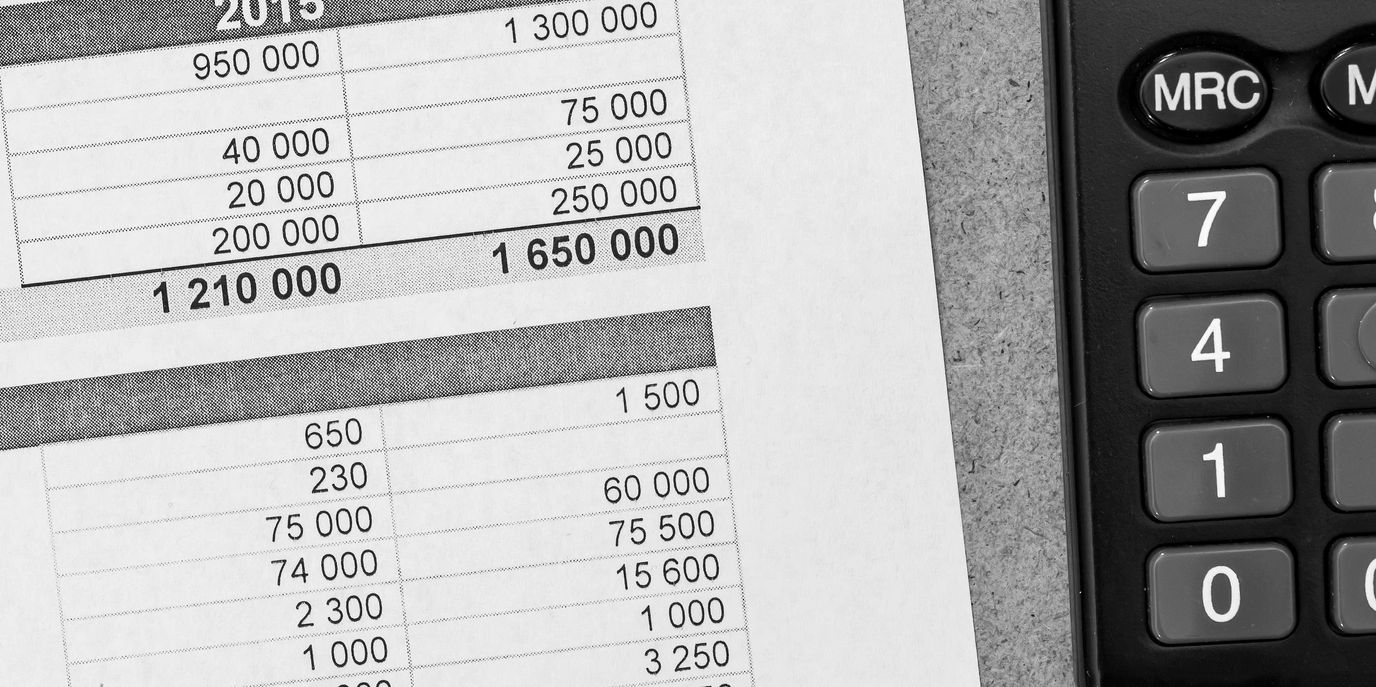

Finance involves managing a company's financial resources, focusing on budgeting, investments, risk management, and financial planning. It ensures that a business has the capital needed to operate, grow, and meet its financial goals.

BUSINESS FINANCE

BUSINESS FINANCE

BUSINESS FINANCE

Business finance is the application of financial principles and data-driven strategies to help companies make informed decisions about their resources. It involves everything from budgeting and forecasting to investment analysis and risk management. Leveraging financial models, technology, and analytics, businesses can optimize operations, maximize profitability, and navigate market fluctuations. Unlike traditional finance, modern business finance prioritizes agility, innovation, and data-backed insights to ensure long-term sustainability and growth in an ever-changing economic environment.

PERSONAL FINANCE

BUSINESS FINANCE

BUSINESS FINANCE

Personal finance has evolved with the rise of digital tools, automation, and global connectivity, enabling individuals to manage their money more efficiently than ever before. Budgeting apps, robo-advisors, and online investment platforms are transforming how people save, invest, and plan for the future. These modern solutions prioritize convenience, data-driven insights, and personalized financial strategies, allowing individuals to take control of their financial well-being. Unlike traditional methods, today’s personal finance approach emphasizes speed, accessibility, and smart technology to adapt to the fast-paced financial landscape.

Next Section: Business Finance

Business finance involves managing a company’s financial resources, focusing on budgeting, investments, and risk management to ensure growth and profitability. It uses data and strategies to optimize financial decisions and drive business success.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.